In a world where everything that can be, is being computerized in order to increase efficiency, it seems paradoxical that some business owners are still carrying out their accounting manually. Yet manual accounting is still commonplace, especially with small businesses.

[lwptoc]

Manual Accounting

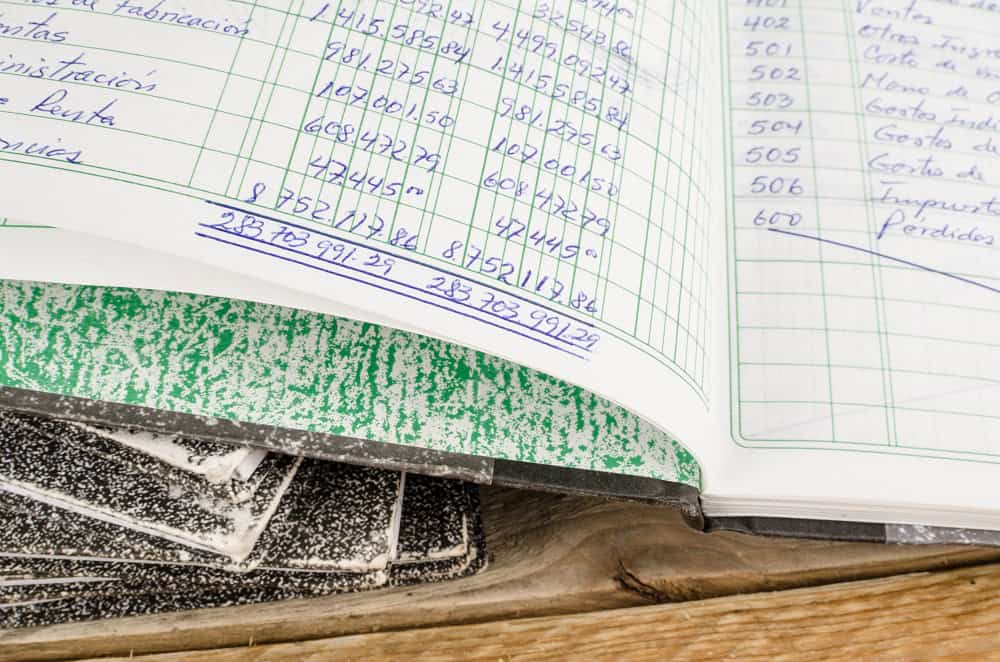

Manual accounting refers to a system of accounting where financial business records are hand written in pads, books and ledgers, without the use of a computer. Manual accounting systems are especially popular with businesses that are just starting out or that have few transactions.

The simplest kind of bookkeeping, usually for very small numbers of daily records, is single entry, where one entry for each transaction is written per row into a cash book. A minimal amount of detail is recorded, such as the date, a description, income and expenses, bank balance, and perhaps a reference such as an invoice number.

A single entry bookkeeping system is easy to maintain, even for someone who knows nothing or very little about bookkeeping and accounting, and has a minimum of requirements. However, one of the problems with single entry accounting is that it is relatively easy for errors to creep in, which can in turn be hard to detect and locate.

A more robust system is the double entry bookkeeping system. Any type of business activity, such as buying or selling, constitutes a transaction which produces a document, as in a sales invoice when a product or service is sold.

The sales invoice is referred to as an accounting source document and usually includes details like the date, name of the person or company to whom the product or service is being sold, description of the goods or services, and a monetary amount.

Regardless of whether the transaction is a sale or purchase, the details are first written into a journal (in chronological order) that describes the transaction, and then into a ledger. The journal entry also includes what ledger accounts are affected.

Ledgers are defined as books of financial accounts, with three ledgers being used in a double entry system: the general ledger, the accounts receivable ledger, and the accounts payable ledger. In double entry accounting, each transaction affects two account entries, using debits and credits.

Debits are always written on the left hand side of the ledger, and credits are always written on the right hand of the ledger. It is the bookkeeper’s job to correctly process debits and credits and ensure that ledger balances are maintained.

The closing balance for each ledger is usually calculated at the end of each month, when reports are also produced. Closing balances are generally written on either the left or right hand side of the ledger, depending on whether there was an increase in the debit or credit forthat account.

The bank ledger’s closing balance has to be reconciled against the bank’s statement of account, to ensure the closing balance in the ledger matches that of the bank statement. And finally, the profit and loss report is prepared so the business owner can see if they have made a profit or a loss.

Computerized Accounting

As the name suggests, computerized accounting uses some type of accounting software running on a computer system. The software may be a dedicated accounting package or something as simple as a spreadsheet.

Computerized accounting employs the same concepts and procedures as manual accounting, but streamlines the entire process. Transactions are manually typed into the system, although, in more sophisticated setups, a level of automation is also possible.

For example, the accounting software can automatically sync with business bank accounts and credit cards, and capture sales transactions from point of sale (POS) systems, entering them directly into the system without human intervention.

Where computerized accounting really shines though, is in the production of reports. Reports can be generated as and when required, not just at the end of the month as is the case with manual accounting practices.

The Difference Between Manual Accounting and Computerized Accounting

As was stated at the outset, some businesses, especially small businesses or those just starting out, prefer to use manual accounting. In its most basic form, it is simple to maintain, especially for those that find using a computer daunting.

Because manual accounting does not require a computer system or the expense of buying or subscribing to an accounting software package, it is low cost, something that could be a major consideration for a business just starting out.

Some also argue that manual accounting books are more easily accessible. Accounting software tends to have a lot of options and settings that can be confusing to the ordinary user. With manual accounting, it’s just the books, and there’s no labyrinth of fancy menus to navigate through.

And if there is a power outage, as long as there is a light source available, entries can continue to be made in a manual accounting setup. Many business owners also feel safer if their business dealings are not available on a computer connected to a network, fearing the possibility of being hacked, especially with many accounting software packages today, moving to cloud storage.

On the other hand, there’s just the one copy of the books in manual accounting. If they were to be stolen, or suffer some type of damage from fire or other kind of disaster, there’s no way to retrieve the lost records. In a computerized accounting system, there is normally at least one backup copy, with copies being taken nightly.

Manual accounting is also very labor intensive, especially with a double entry system where each transaction is recorded in journals and ledgers. With a computerized accounting system, a transaction is only entered once and the software takes care of the rest.

As long as the information typed into a computerized accounting system is correct, the chances of error is almost none. The software does not make any arithmetical errors in its calculations, unlike a manual accounting system where human error is very likely.

While both manual and computerized accounting setups do eventually require the intervention of an experienced accountant, the more elaborate the manual accounting system deployed, the greater the requirement for an accountant with extremely good knowledge of bookkeeping and accounting practices to keep the books balanced.

Where computerized accounting has a distinct edge over manual accounting, is in its ability to generate the monthly financial reports, or indeed a variety of reports, all at the press of a keystroke. There’s no need to wait for the end of the month, or rely on an accountant to do the math. An ordinary user can print out any number of reports at any given time.

Finally, computerized accounting software is usually capable of integrating with other business related systems such as payroll administration, resource planning, and time and expenditure monitoring, with a minimal of effort.

As always, which system is better is dependent on the needs and the budget available to the business, as well as what feels most comfortable for the person responsible for the entity’s finances.

While manual accounting is probably the cheapest and simplest way to start out, a very basic computerized accounting system using a spreadsheet is not far behind, with complete accounting software packages being a necessity for businesses with a high volume of transactions or with more demanding accounting requirements.